How is the reimbursement determined?

When you are working for Staffice, in most cases, you receive a travel expense reimbursement. The reimbursement you receive depends on the policy applied by the client you are assigned to. You are entitled to the same reimbursement/policy as a permanent employee. Please note that each company has its own policy, which can vary significantly from one another.

How is the reimbursement paid?

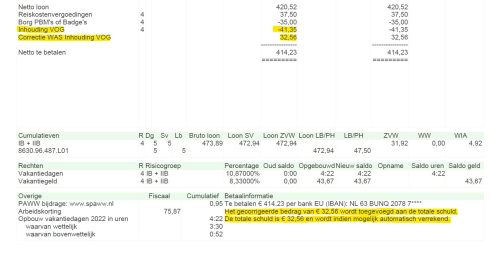

Once we have assessed your travel expense reimbursement, we ensure that it is paid with your salary. You will see a line item stating “Travel Expense” or “Reiskostenvergoeding “. Usually, a fixed reimbursement per day is applied, and you will also see the number of days you have received, which is usually equal to the number of days worked. This is clearly indicated on your payslip. If you feel that something is amiss, please let us know, and we will double-check it for you.

To pay tax or not to pay tax?

In most cases, you do not have to pay tax on your travel expense reimbursement. The tax authority has a rule that allows a maximum of €0.21 per kilometer for one-way travel, which is exempt from taxation. Therefore, it is also crucial that you inform us promptly if you move, so we can verify if your travel expense reimbursement needs to be adjusted.

To subscribe or not to subscribe to public transportation?

The reimbursement you receive from us is usually sufficient to cover the cost of a monthly subscription. This is much cheaper than buying a ticket every day. Our advice is, therefore, to consider getting a subscription if you frequently work at the same location. In most cases, this is the best option, even if you only work at that location for 2.5 weeks per month. Additionally, it’s good to explore alternatives such as commuting by bicycle or partially cycling your route. Not only is this healthy, but it also saves you some money, which you can use for enjoyable activities.

Interested in subscribing? Visit https://9292.nl/.